Msci Emerging Markets Index / C51rucnet9vdnm

Informazioni finanziarie sullindice MSCI Emerging Markets MSCIEF. Accedi immediatamente al grafico gratuito in streaming dellindice MSCI Emerging Markets.

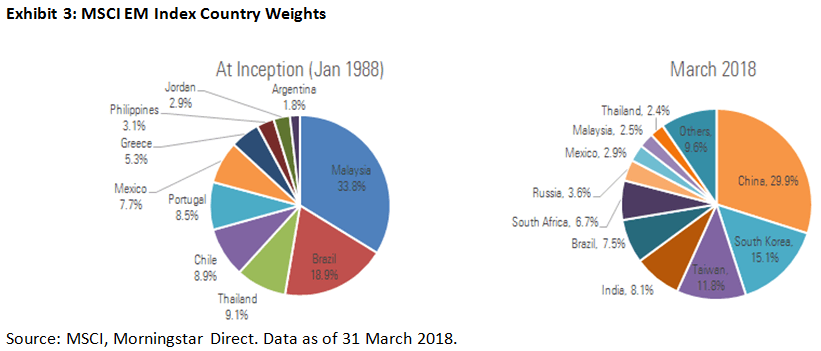

Msci Emerging Markets Index Country Weights Jan 1988 Vs March 2018 Chart Topforeignstocks Com

MSCI emerging and frontier markets indexes.

Msci emerging markets index. MSCI dividend masters indexes. 52 week range 105302 - 144938. MSCI diversified multiple-factor indexes.

891800 A complete MSCI Emerging Markets Index USD index overview by MarketWatch. MSCI investable market indexes. What Is the MSCI Emerging Markets Index.

NAV as of Aug 20 2021 4945. MSCI Emerging Markets Index. MSCI Emerging Markets Index Der MSCI Emerging Markets Index umfasst die Aktien von etwa 1200 Unternehmen mit hoher und mittlerer Marktkapitalisierung sogenannte Large- und.

Todays Change 000 000. Fees as stated in the prospectus Expense Ratio. Revenue Streams From Emerging Markets Will Likely Drive Future Growth.

MSCI quality and high dividend yield indexes. La panoramica comprende dati come prezzo attuale chiusura precedente variazione su base annua volume e altro ancora. It is a leading index that has been created by MSCI Inc.

Find the latest MSCI EMERGING MARKETS INDEX EMX stock quote history news and other vital information to help you with your stock trading and investing. Il grafico è intuitivo ma efficace offre agli utenti vari tipi di grafici compresi quelli a candela ad area a linee a barre e Heiken Ashi. MSCI high dividend yield.

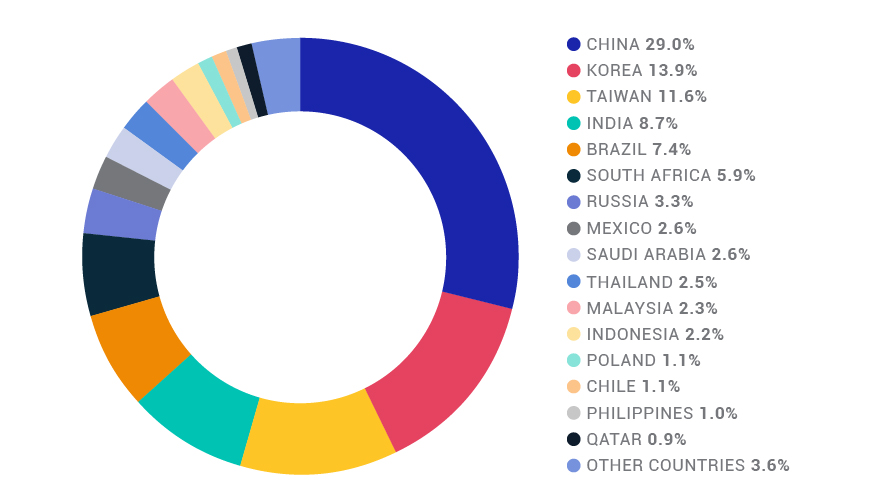

1 Year change 2007. As of June 2021 it covers more than 2900 constituents across 11 sectors and approximately 85 of the free float-adjusted market capitalization in each market. MSCI Emerging Markets Index USD The MSCI Emerging Markets Index captures large and mid cap representation across 27 Emerging Markets EM countries.

Addiitonally our speakers discuss how sound investment decision making is supported. View stock market news stock market data and trading information. IShares MSCI Emerging Markets ETF.

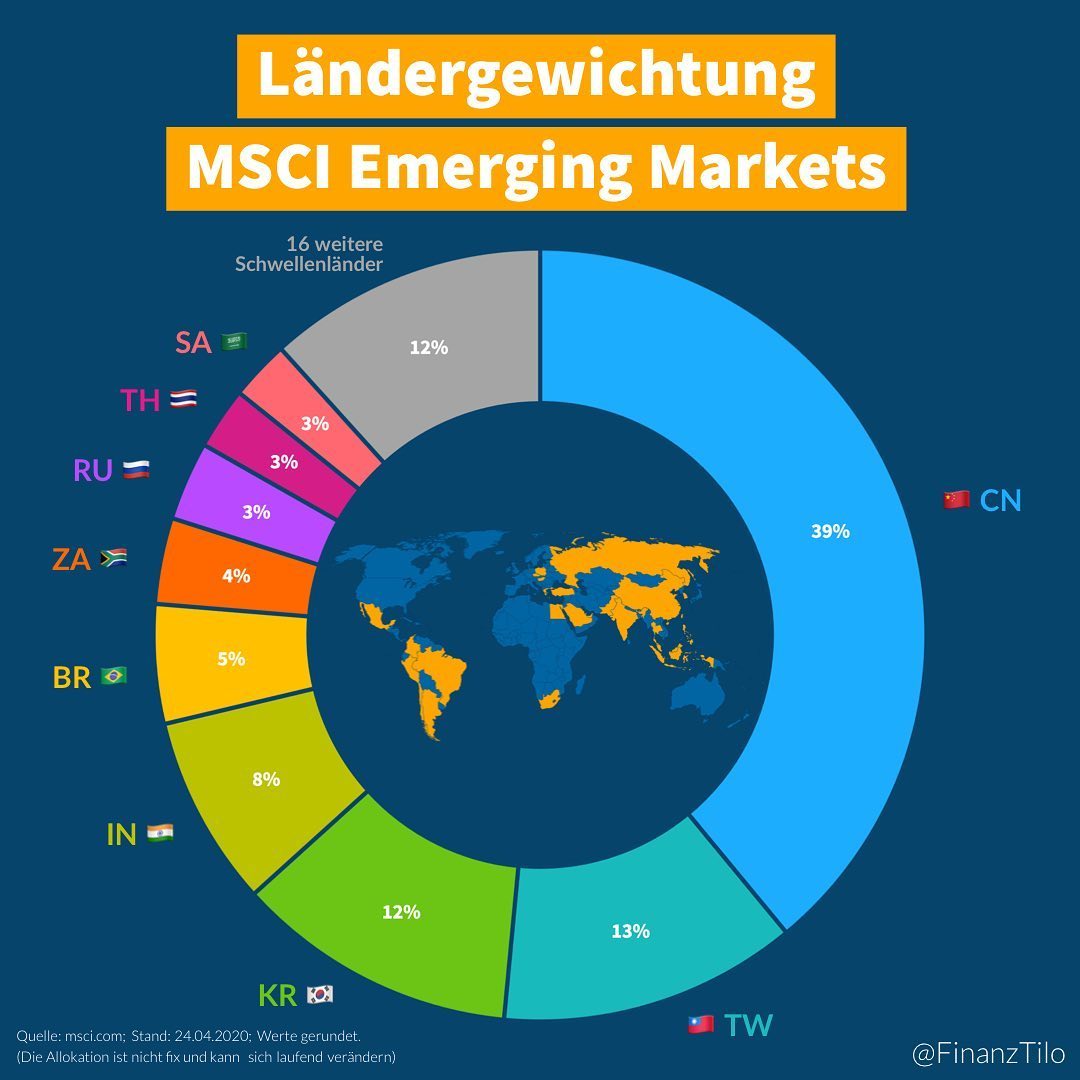

Currently it captures 26 countries across the globe and has a weight of 12 in the MSCI ACWI Index. Updated on August 21 2021 2 views. Índice MSCI All Colombia Local Listed Risk Weighted.

Its top holdings. The MSCI ACWI Index MSCIs flagship global equity index is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 27 emerging markets. The MSCI Emerging Markets EM Index was launched in 1988 including 10 countries with a weight of about 09 in the MSCI ACWI Index.

MSCI MSCI 16 hours Is MSCI A Smart Long-Term Buy. 1 Day NAV Change as of Aug 20 2021 -017 -034 NAV Total Return as of Aug 19 2021 YTD. The MSCI Emerging Markets Index is used to measure the financial performance of companies in fast-growing economies.

The index tracks mid-cap and large-cap stocks in 27 countries dominated by Chinese Taiwanese and South Korean. MSCI Emerging Markets Grafico Interattivo. MSCI Factor Mix A-Series Indexes.

MSCI Emerging Markets Index. Accedi immediatamente al grafico gratuito in streaming e in tempo reale dellindice MSCI Emerging Markets. The MSCI Emerging Markets Index fund helps in measuring the financial stability of leading companies in rapidly-emerging countries of the world.

The final episode of the of the emerging markets video series focuses on why emerging markets are integral to global investing along with the drivers behind sustained growth in emerging markets allocation by institutional investors. MSCI Select Value Momentum Blend Indexes. Revenue Streams From Emerging Markets Will Likely Drive Future Growth and dont miss much more articles reports and business analysis below.

MSCI Emerging Market Index. Constructed according to the MSCI Global Investable Market Indexes GIMI Methodology the MSCI EM Index is designed. With 1406 constituents the index covers approximately 85 of the free float-adjusted market capitalization in each country.

MSCI equal weighted indexes. Questo grafico professionale avanzato ti offre una visione completa sui principali indici mondiali. -former Morgan Stanley Capital International.

Bloomberg a global leader in fixed income indexing and MSCI the worlds largest provider of ESG environmental social and governance equity indexes and research have collaborated on the development of the markets first fixed income index family. MSCI Dividend Points Indexes. MSCI top 50 dividend indexes.

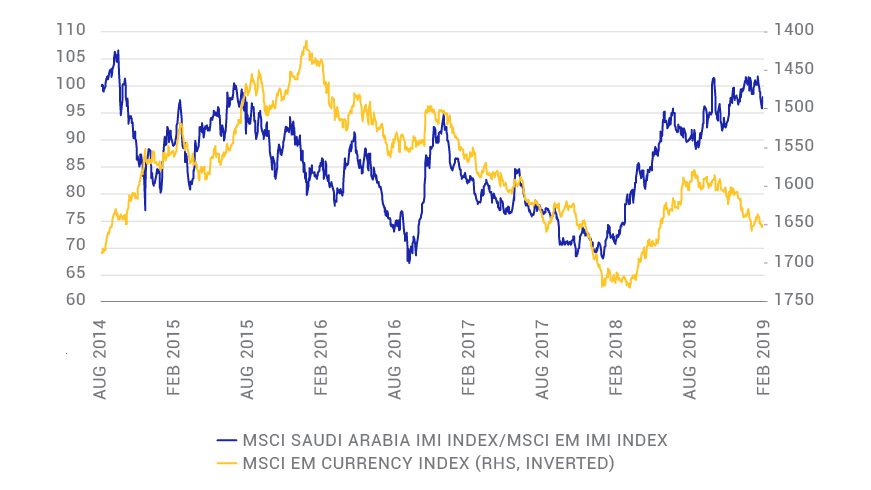

Saudi Arabia Inclusion And Emerging Markets Msci

Msci Emerging Markets Index Marketing Emergency Secularism

The Three Stocks Msci Is Inducting Into Its Emerging Markets Index Frontera

Msci Emerging Markets Index Tech Charts

Emerging Markets Ein Klarer Fall Fur Contrarian Investoren The Market

Fidelity Msci Emerging Markets Index Fund P Acc Eur Fonds Kurs Ie00byx5m476 A2je5t Ohne Ausgabeaufschlag Kaufen

Performance Of Healthcare Stocks Versus All Stocks Emerging Market Download Scientific Diagram

Top Msci Emerging Markets Etfs Find The Best Msci Emerging Markets Etf Justetf

Msci Emerging Markets Wikipedia

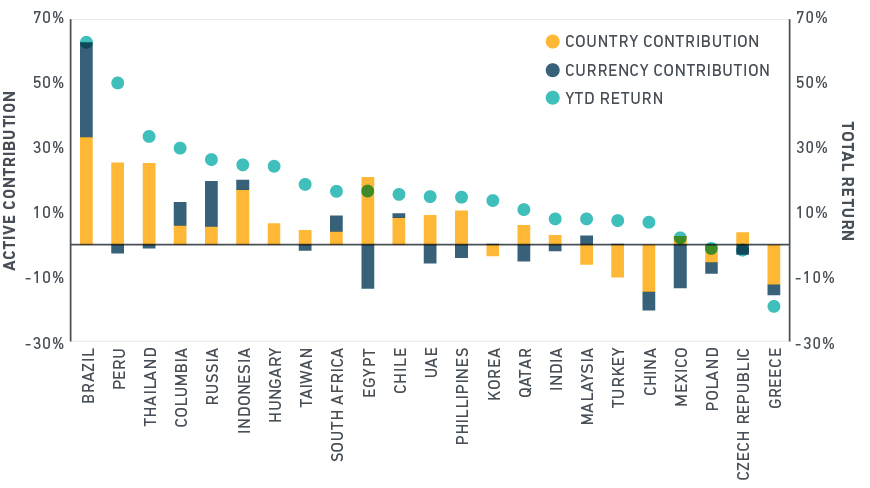

Insight Into The Emerging Markets Rally Msci

Msci Emerging Markets Index Tech Charts

Landergewichtung Im Msci Emerging Markets Index Finanztilo

Neuerungen Beim Msci Emerging Markets Index Erste Am Blog

Der Entwachsene Bruder Msci Emerging Markets

Mit Einem Msci Emerging Markets Etf In Schwellenlander Investieren

Saudi Arabia Inclusion And Emerging Markets Msci

Msci Emerging Market Index An Overview Recent Trends And The Future Performance Forecast Ig En